It’s become a popular meme that Wall Street firms—most notably Blackrock—are buying up homes across the United States at record numbers to make Americans a “nation of renters.”

While there are plenty of valid criticisms of Wall Street and plenty more of Blackrock (for example, being bailed out by the Federal Reserve when Covid hit and then being selected by the Fed to run a massive and very lucrative program buying hundreds of billions of dollars of debt from large companies)

But buying up tons of houses to make housing unaffordable for the average American is not one of their sins. At least, not if you think it requires buying more than one percent of America’s housing stock to actually make housing unaffordable.

As I’ve noted elsewhere, the United States had approximately 83.3 million single-family houses in 2018. How many did Wall Street own? Well Gary Beasley did his best to answer that question. As he noted in Forbes,

“Researchers at my company, Roofstock, estimate that large-scale landlords today own approximately 450,000 of the roughly 20 million single-family rentals in the U.S. While this represents considerable growth over the past decade, it represents less than 2.5% of all single-family rentals and less than 0.5% of all single-family homes (including owner-occupied).”

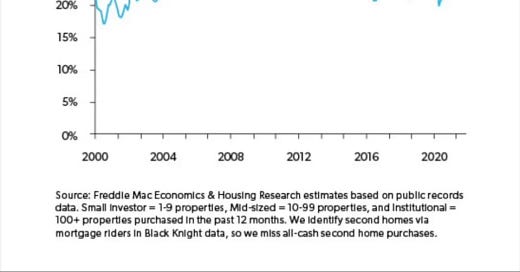

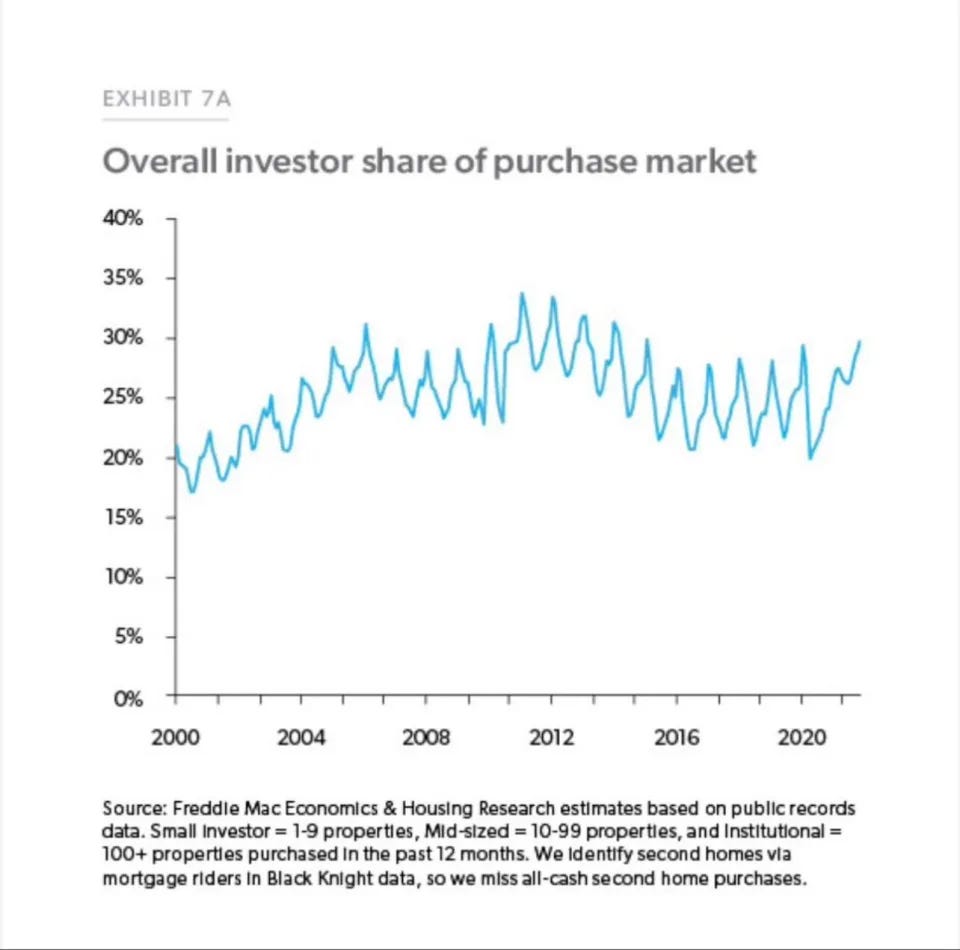

Logan Mohtashami for Yahoo! Finance shows that percentage of single-family homes owned by investors has remained relatively flat since 2010.

Further, Mohtashami notes that “the vast majority are small mom and pop investors.” He points to this chart from John Burns Real Estate.

As is plainly clear, intuitional investors own only a very small fraction of investment properties and investment properties on the whole are outnumbered more than two to one by homeowner occupied homes.

Wall Street is not buying up Main Street… or at least not very much of it.

If you want a better understanding of what is causing the affordability crisis (other than interest rates), we made a video on the topic a while back that should explain it.

You can find the book here.

And the audiobook here.

And if you like the book, please subscribe to my YouTube channel as well.

What they also don't consider is that many of those large hedge fund investors are BUILDING houses, ENTIRE subdivisions. How does that factor in, how many of the houses that these big companies own did they actually build and add to the housing stock!