The European energy crisis going into the winter is truly hard to believe and could have major reverberations around the world.

Just look at the cost of natural gas futures in Europe,

Even with the recent downtick, that’s an 800 percent increase from a year ago! It’s hard to imagine the average citizen being able to afford such a brutal rate increase.

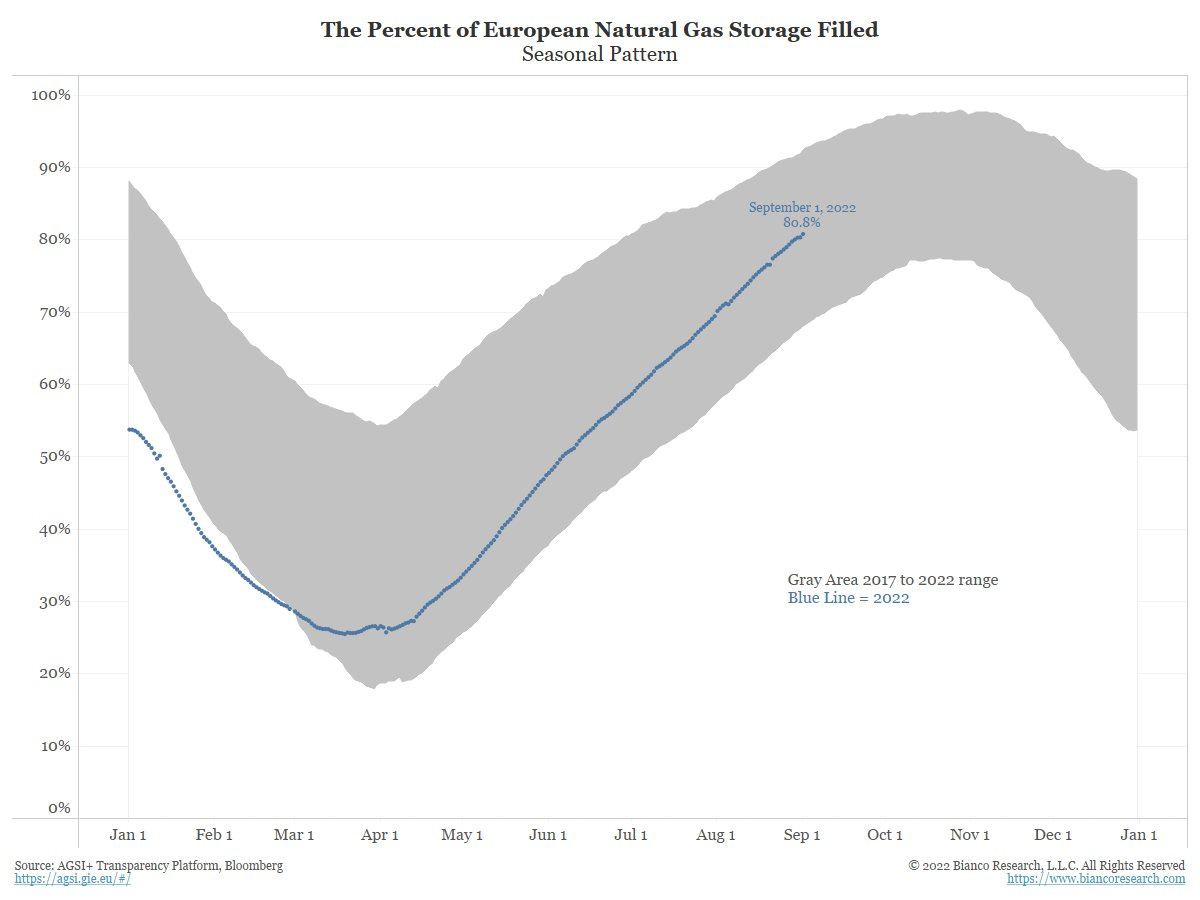

And while it’s true that gas storage is 81 percent filled as of the beginning of September and in line with previous years. That gas was bought at an enormous premium which, even with government subsidies, will have to be passed onto consumers at a much higher rate than in previous years.

The country that will be worst affected is by far and away Germany. Major protests were happening to end the sanctions against Russia in order to bring back gas deliveries before Nord Stream 2 was sabotaged. Now Germany’s very cold and very expensive winter is inevitable and will likely sink the German economy into a very deep economic recession and possibly a depression.

As Spiegel International notes, this recession could spell the end of much of German industry,

"The current gas crisis has all the 'ingredients for this to be the energy industry's Lehman Brothers,' Finnish Economic Affairs Minister Mike Lintilä said recently. Back in 2008, investment banks triggered a global financial and economic crisis by selling toxic home mortgages tied up in wild securities constructs. This time, it is high gas and electricity prices that could trigger a systemic collapse...

"Many companies are unlikely to survive. In August alone, the number of insolvencies among corporations and partnerships, mostly medium-sized firms, grew by a quarter year-on-year. For October, Steffen Müller of the Leibniz Institute for Economic Research in Halle predicts an increase of one-third compared to 2021. And this doesn't even take into account the increased energy costs and inflation. Müller expects a structural change in the German economy. Due to the long-term cost increases in energy, wages, intermediate products and interest rates on loans, 'some business models are just no longer sustainable.' Müller says that weak companies 'are now getting flushed out of the market.'"

And unlike your typical financial shocks, if Germany (and Europe on the whole) cannot develop sources of relatively inexpensive energy going forward, the economic fallout may be much more permanent than a typical recession.

While our thoughts and prayers should be with the German people through what will be a harrowing winter, we must also keep an eye on and prepare for what could very well be a global contagion could come from the collapse of German industry. The “Lehman Brothers” of the energy industry perhaps.