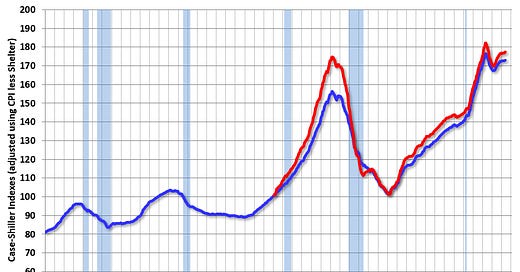

Real Estate Values Are Just About Flat Since Interest Rates Went Up in 2022

When adjusting for inflation, that is

I’ve noted multiple times that the real estate market would remain relative stable both before and after interest rates began to skyrocket in 2022 because of the “golden handcuffs” of long-term, fixed loans with really low rates. And in fact, that’s what’s happened as nominal prices didn’t even go negative (year-over-year) for a single month.

I get things wrong (I predicted a recession in early 2023 for example) but I definitely called this one. Indeed, “stable” is almost an understatement. In real terms (i.e. adjusted for inflation) real estate is almost completely flat.

As my go-to-source on the real estate market, Bill McBride, notes,

“In real terms (using CPI), the National index is 1.6% below the recent peak, and the Composite 20 index is 2.0% below the recent peak in 2022. Both indexes increased in June in real terms boosted by the slight month-over-month decline in inflation in June.”

Graphically, it looks like this. Definitely not a crash…

We should thereby expect real estate prices to start outpacing inflation if the Fed lowers interest rates as most expect them too. The only reason they wouldn’t is if the economy does indeed enter a recession.

And we’re due for one more likely sooner than later. (How’s that for hedging my bets like any good economist?)

You can find my other book, Awesomeness, here.

And the audiobook here.

And please subscribe to my YouTube channel.