New BiggerPockets Article: Why is the Delinquency Rate For Commercial Real Estate Surging?

And why is delinquency on residential flat?

This is an excerpt from an article originally published on BiggerPockets.com

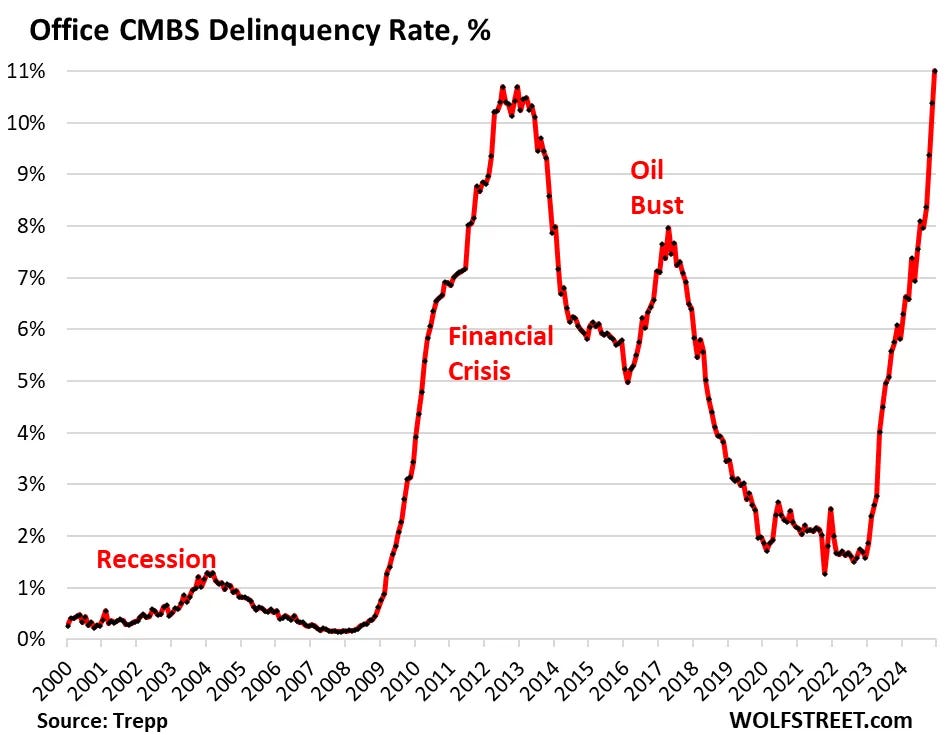

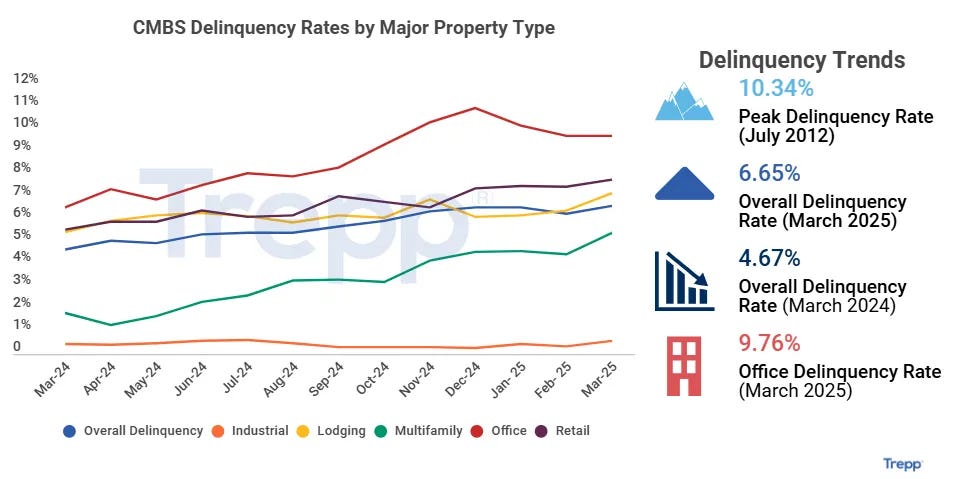

Before President Trump’s tariff announcement sent markets into a tizzy, the big news in the real estate world was that the surging rate of delinquency on commercial mortgage-backed securities, most notably in the office sector. Indeed, in December 2024, the delinquency rate on office CMBS hit 11%, exceeding even its peak during the height of the 2008 real estate meltdown!

But aside from industrial (with a 0.6% delinquency rate in March 2025), each are still relatively high, with a March 2025 average of 6.65%, and have also been trending upward throughout 2024 and early 2025.

This sounds bad. Indeed, I saw multiple posts on social media talking about this development as if we were on the precipice of another real estate-driven financial collapse—this time driven by commercial real estate.

Now, a recession very well may be imminent (or may even have already started). J.P. Morgan puts the odds of a global recession at 60% right now. But if this happens, it will be driven by a combination of an overvalued stock market, strapped consumers, geopolitical uncertainty, and a trade war, not real estate.

The reason is simple: Commercial real estate is a relatively small percentage of real estate overall. The office sector itself only amounts to about 16% of commercial real estate as of 2018, and commercial real estate is only 19% of all real estate. (Industrial, retail, hospitality, and multifamily make up the other types of commercial real estate, although it is sometimes broken down further with sectors like medical or special-purpose included.)

All residential real estate (including multifamily, which is confusingly classified as commercial) accounts for 81% of all real estate.

Thus, the office sector accounts for substantially less than 10% of the real estate sector as a whole. And single-family housing is the biggest sector by far. (There are about 85.3 million SFR and 32.6 million multifamily units in the United States as of this year.)

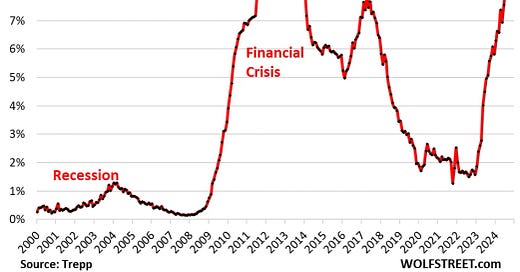

Single-family homes were the epicenter of the 2008 mortgage meltdown, but the trends in delinquency for single-family homes haven’t budged at all in the last three years since coming down from a brief COVID-19 pandemic-induced spike. As of February 2025, serious single-family delinquencies are sitting at just 0.61% for Freddie Mac and 0.57% for Fannie Mae.

This graph makes it look as if the economy is in tip-top shape.

That said, this is a bit misleading. Serious delinquencies mean the loans are at least 90 days past due. The CMBS delinquency data is for 30-day delinquencies or more. In order to compare like with like, we have to look at 30-day delinquencies, which Fannie Mae and Freddie Mac did not report.

The Mortgage Bankers Association National Delinquency Survey (NDS) looks at a slightly different cohort than Fannie and Freddie. It includes loans on any property that is one to four units and includes non-Fannie and non-Freddie mortgages. Their most recent survey found a total delinquency rate of 3.98% for such mortgages in Q4 2024, of which 1.19% were at least 90 days past due.

Still, this is barely more than half of CMBS and a third of the office CMBS delinquency rate. And further, residential delinquency rates remained flat for years, whereas commercial is going up and office is surging.

So what’s going on?

…

To read the read the rest, please visit to BiggerPockets.com

You can find my other book, Awesomeness, here.

And the audiobook here.

And please subscribe to my YouTube channel.