Are the Big Four Banks De Facto National Banks?

The "Too Big to Fail" Banks Have Swallowed Up Their Competition Over the Last Few Decades

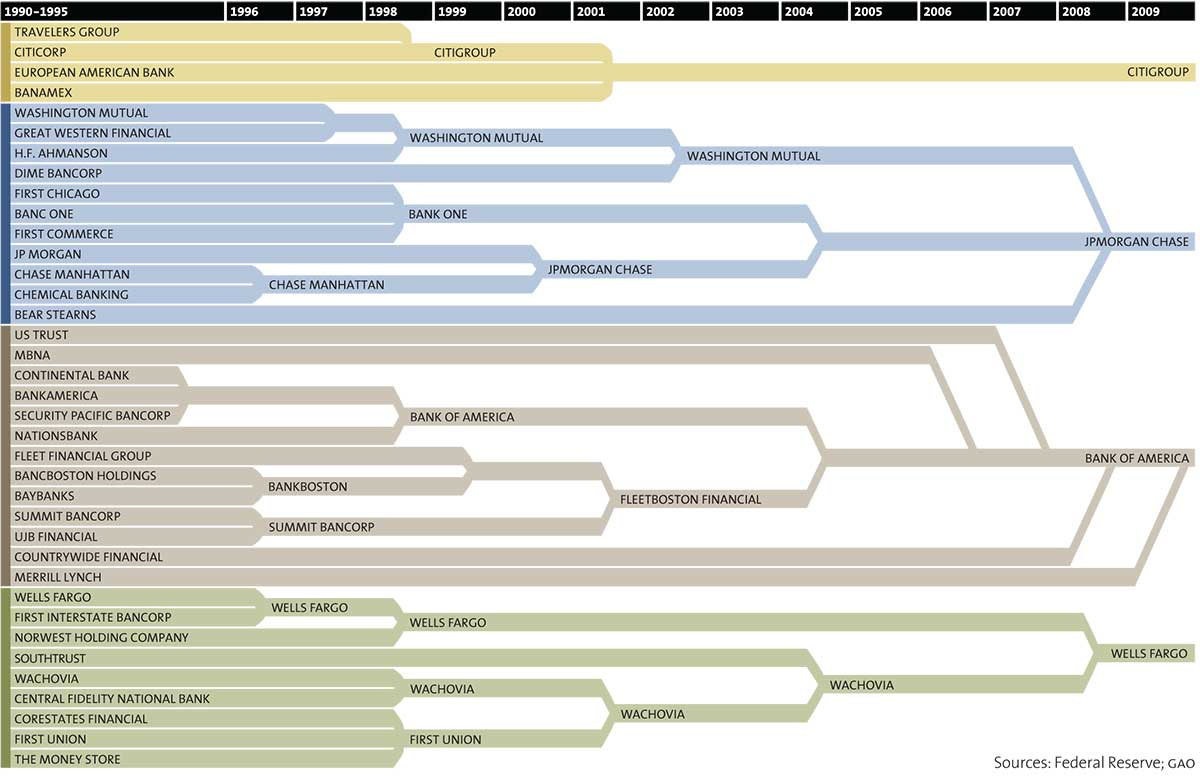

After listening to a recent podcast with investor David Sacks, it’s become quite apparent that the United States has meandered (perhaps maliciously) itself into the unenviable situation of having what amounts to de facto national banks. Namely four: Citigroup, JPMorgan Chase, Bank of America and Wells Fargo.

I mean, just look at this chart of the banking consolidation that has taken place since the mid-90s.

Sacks point was that bailing out the depositors (as opposed the shareholders or bondholders) of Silicon Valley Bank and Signature Bank was a must do. Of course, this creates moral hazard and the FDIC and Federal Reserve are now basically just making it up as they go. (Indeed, will a community bank’s depositors be bailed out if it fails?)

But had the feds not bailed out the depositors, it would create an enormous incentive for businesses and high net worth individuals to abandon small and regional banks and go with the big four, because as we all know, they are “too big to fail.”

Sacks even said this probably wouldn’t have be an issue if it wasn’t Silicon Valley Bank that collapsed but instead it was instead Farmers Bank or something like that. People are rightly pissed off at Silicon Valley right now for everything from mass censorship to intentionally making addictive products that appear to be wrecking the self esteem of young people.

Perhaps that’s true, but regardless, it’s not exactly fair to be forced to pay for other people’s deposits being held in institutions that didn’t manage inflation risk well. But if the tradeoff is a banking panic and further consolidation of the banking industry, it’s probably a tradeoff we should make.

I lean libertarian and it’s clear that collusion between the government and these banks created this situation. But it’s hard to see what else to do now but either make the FDIC back all deposits (in which case, what is the point of banks?) or just break these four institutions up into their constituent parts.

Or just drop the idea of “too big to fail” and let the cards fall where they may if one of these institutions gets into trouble.

But given the fact we all know they would never follow the last option, breaking them up is probably the least bad option available. Maybe Bernie was right, at least on this one.

"“There are no solutions, there are only trade-offs"

-Tomas Sowell"

- Phillip Syrios