An Operating Costs Crisis That’s Driving Many Landlords Out of Business: New BiggerPockets Article

And how to address it

This is an excerpt from an article originally published on BiggerPockets.com

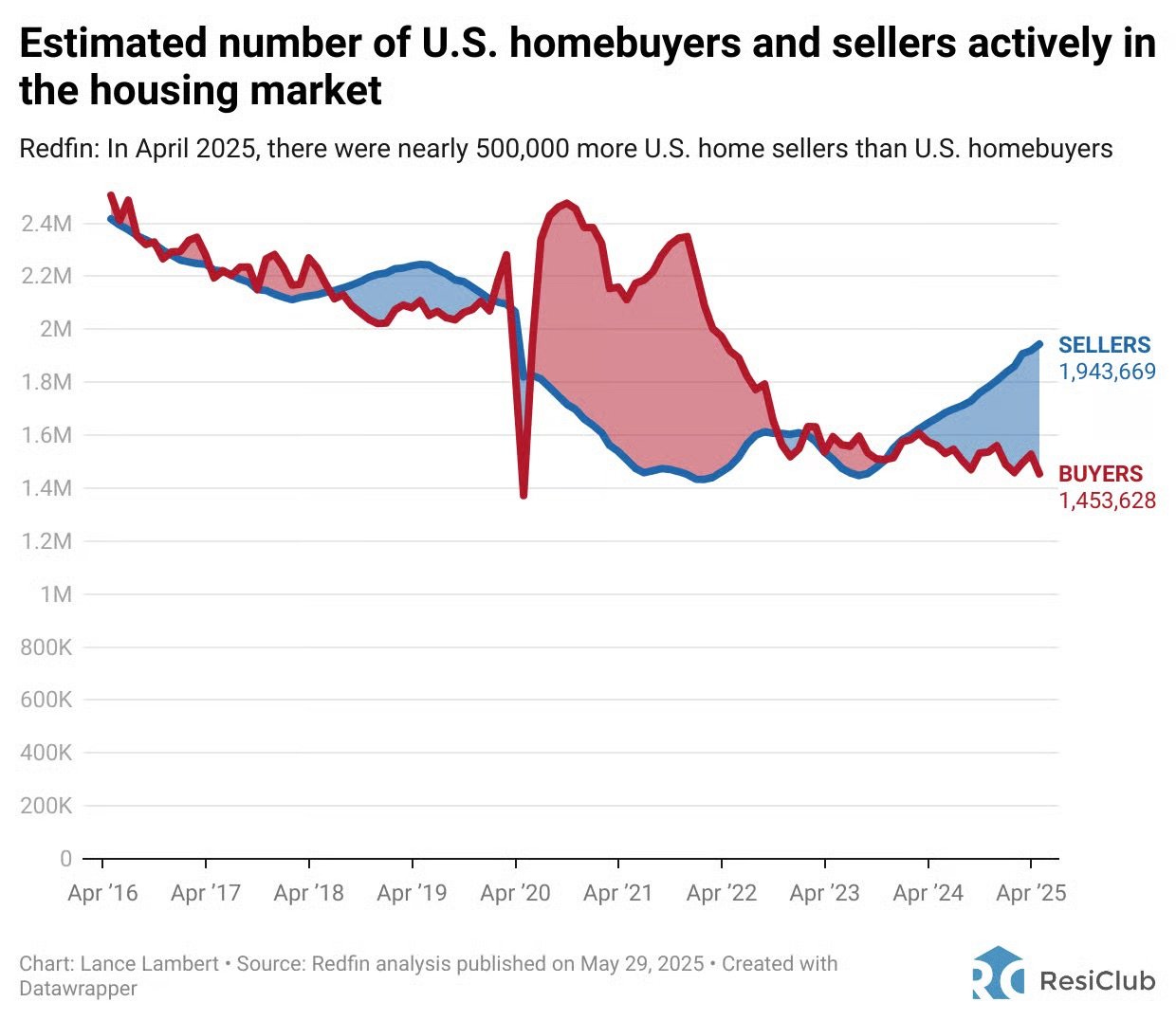

Over the past year, the gap between the number of active sellers and active buyers has widened to its largest margin since the wake of the Great Recession. According to Redfin, as of April 2025, sellers outnumbered buyers nearly 4 to 3, with a full 500,000 more selling their homes than looking to buy one.

This does not mean that another real estate-driven financial crisis is approaching (mostly due to stronger borrowers with low-interest, fixed loans, unlike the subprime teaser rates of pre-2008). But it does clearly indicate that the real estate market is softening. And this comes at an inopportune time, as a silent crisis has been eroding the cash flow of real estate investors for several years now: the operating cost crisis.

While I rarely see it discussed openly, every investor I’ve talked to recently has felt the squeeze that operating costs have put on our businesses. Just take a look at how much various operating costs have gone up in 2024:

Property taxes nationwide went up an average of 5.1%

Home insurance went up an average of 10.4%

Meanwhile, wages went up 4.2% as of March

All these are substantially higher than the current inflation rate.

Some price growth has actually moderated, but only after enormous increases in the past few years. For example, construction material prices only went up only 1.3% in 2024, but that’s after increases in 2021 and 2022 of 14.6% and 15%, respectively. Gas prices have actually come down for two straight years, but are still over 50% higher than they were in 2021. Electricity rates only increased 0.9%, but that was after a 12.1% surge in 2022.

Furthermore, with the recent federally mandated switch from using R-410A to R-454B AC units, HVAC prices are likely to rise dramatically.

Meanwhile, asking rents only increased 0.4% year over year as of February.

And this could get even worse with the potential fallout of the new tariffs or further instability in the Middle East.

All this is happening in a market where home prices are still, at least nominally, higher than they’ve ever been, and interest rates are as high as they’ve been since the late ‘90s. And refinancing is usually cost-prohibitive.

Many have concluded that the BRRRR strategy simply doesn’t work right now, and I tend to agree. But we and many others still have a lot of rentals, and it’s getting harder and harder to keep them cash flowing.

So let’s dive into some of the best ways to ensure they do keep cash flowing, even in this very challenging environment. We’ll start by looking at ways to cut operating costs.

First up is debt service.

Reamortizing Loans as They Renew at Higher Rates

When interest rates shot up in mid-2022, there were many doomsayers who thought the market was going to collapse. This thought was based on a fundamental misunderstanding of the situation, given the low-interest, fixed loans that every homeowner had put no downward pressure on prices.

Unfortunately, most investors don’t have 30-year fixed mortgages. They are usually fixed for five years. So when those renewals hit, your interest rate, and thereby your mortgage payment, spike. This was a large factor in the multifamily recession in 2023 and 2024.

These days, whenever one of our loans is up for renewal, we ask to reamortize or recast the loan. In short, we reset the amortization at the beginning as if we were refinancing it.

Given the principal has been paid down and prices have gone up, our banks have been willing to do this without a new appraisal or refinance fees. On one portfolio loan, for example, our interest rate reset from 4.25% to 8%! Yet because we reamortized it, our payment actually went down.

It would work something like this. Say you had a $1 million loan at 4% interest, amortized over 25 years. The payment would be $5,278/month. If it renewed at 6.75% (where rates are as of this writing), the payment would jump to $6,909/month. That’s almost $1,700 more, which is the difference between being in the black and red for many.

However, after five years at the first renewal, the principal would have been paid down to $871,046. After 10 years, on the second renewal, it would be down to $713,594.

Despite the loan being at $871,046, your payments are still based on the original $1 million principal. By reamortizing the loan, your payments are based on a loan of $871,046.

…

To read the read the rest, please visit to BiggerPockets.com

You can find my other book, Awesomeness, here.

And the audiobook here.

And please subscribe to my YouTube channel.